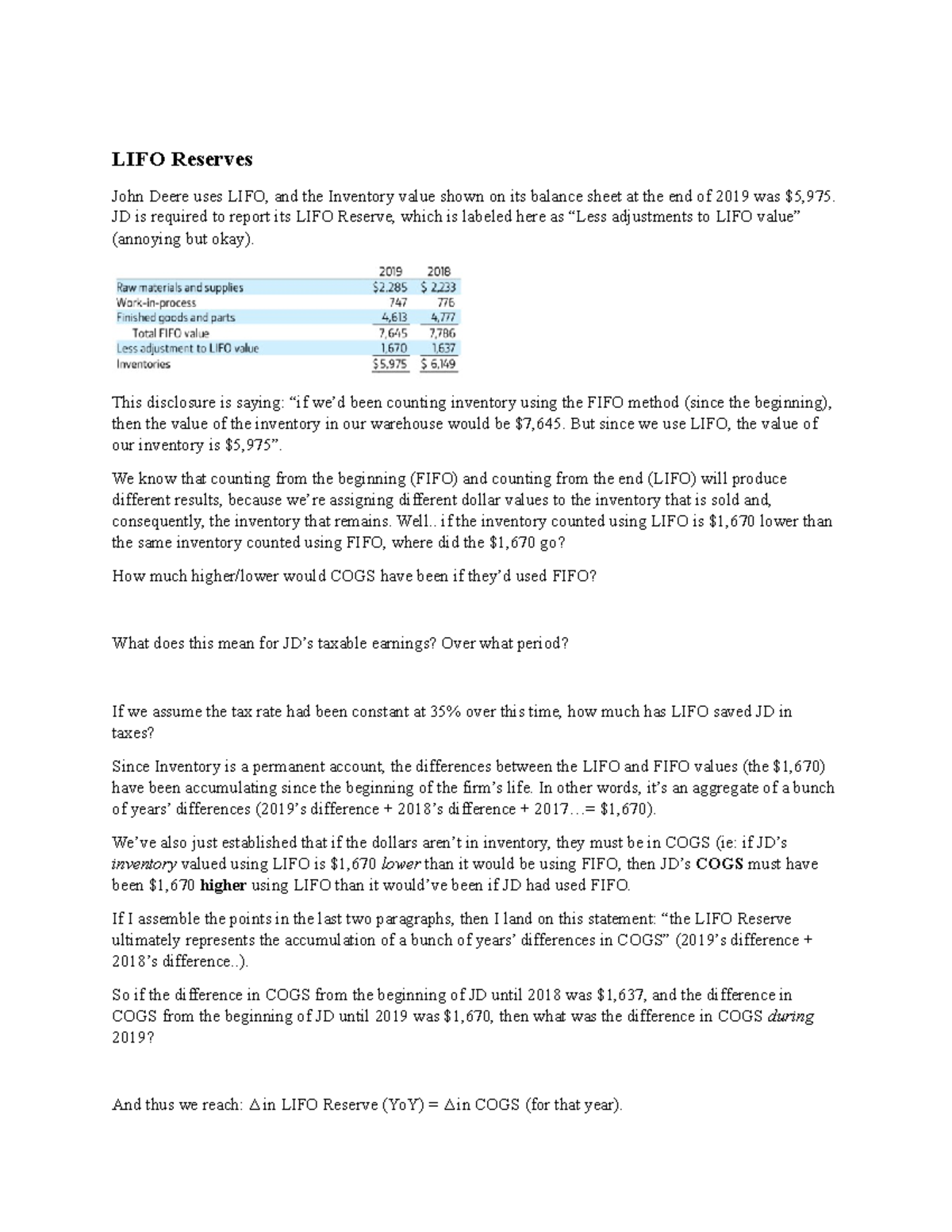

An increasing reserve lowers COGS and raises net income, while a decreasing reserve does the opposite. On the balance sheet, the LIFO reserve amount is generally shown as a contra account that reduces inventory. It indicates that the reported inventory value would be higher if not for the use of LIFO. Since newer inventory costs tend to be higher due to inflation, LIFO usually results in a lower ending inventory value. The difference between the higher FIFO value and lower LIFO value is called the LIFO Reserve.

Recap of LIFO Reserve Formula and Its Significance

LIFO reserve is a bookkeeping technique that tracks the difference between the LIFO and FIFO cost of inventory. It takes the result of the cost of inventory found using the LIFO method and subtracts it from the value of the cost of inventory recorded using the FIFO method. Additionally, significant LIFO liquidation events require adjustments when inventory volumes decline substantially.

Benefits of LIFO Reserve

The Company believes these measures provide useful information for both management and its investors. The Company believes these non-GAAP measures are useful to investors because they provide additional understanding of the trends and special circumstances that affect its business. These measures provide useful supplemental information that helps investors to establish a basis for expected performance and the ability to evaluate actual results against that expectation.

LIFO Reserve and Its Effect on Inventory Valuation

Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. A copy of Carbon Collective’s current written disclosure statement discussing Carbon Collective’s business operations, services, and fees is available at the SEC’s investment adviser public information website – or our legal documents here. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. If the LIFO reserve is depleted, it means that the company has used up all its LIFO reserves and will now have to use the FIFO method to value its inventory.

Absorption Costing: Definition, Formula, Calculation, and Example

Besides, financial ratios are very crucial when comparing the performance of different companies working in the same industry. When the external stakeholders are analyzing the company’s financial health and position in the market, they mainly rely on the financial ratio analysis. Financial ratio analysis offers great insight into the performance of the company. Hence, when comparing two companies – Company A, which follows the LIFO method of Inventory, and Company B, which follows the FIFO method of Inventory, the financial performance and ratios of the two companies become incomparable. Consists primarily of severance and related costs, organizational realignment costs and asset impairment charges.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Let us study the concept of LIFO reserve calculation using LIFO reserve calculation with the help of some suitable examples. Under the LIFO reserve equation, LIFO reserve is the difference between the cost of Inventory computed using the FIFO Method and the LIFO Method.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- The FIFO method is applied to internal reports, and often fuels greater profitability.

- Net Debt is not a measure of our liquidity under GAAP and should not be considered as an alternative to Cash Flows Provided by Operations or Cash Flows Used in Financing Activities.

- The balance on the LIFO reserve will represent the difference between the FIFO and LIFO inventory amounts since the business first started using the LIFO inventory method.

- He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- In this article, we’ve tried to comprehend the concept of LIFO Reserve, and how it is useful for investors and businesses.

For example, if a company reports $1 million in inventory using LIFO but would have reported $1.2 million using FIFO, the are there taxes on bitcoins would be $200,000. This $200,000 bridges the gap between the two valuation methods on the balance sheet. US GAAP requires companies that use the LIFO method to disclose the amount of the LIFO reserve in the notes to the financial statements or on the balance sheet.

For the same reasons, the Company is unable to address the significance of the unavailable information, which could be material to future results. But these impact the tax liability, profits, cash flows, and other financial aspects. In order to create a balance between the two methods and to give a fuller picture of a company’s financial realities, the LIFO reserve account is necessary. The LIFO reserve is designed to show how the LIFO and FIFO inventory valuation systems work and the financial differences between the two. In order to ensure accuracy, a LIFO reserve is calculated at the time the LIFO method was adopted.

However, tis concept is limited to the US mainly because the LIFO metgod is allowed only as per the Generally Accepted Accounting Principles (GAAP). The LIFO accounting is not allowed by the International Financial Reporting Standard (IFRS), thereby making the rules of accounting different based on the method followed by the particular country. The year-to-year changes in the balance within the LIFO reserve can also give a rough representation of that particular year’s inflation, assuming the type of inventory has not changed.

However, for financial reporting purposes, it’s required to calculate what the inventory’s value would be if it used FIFO, which would be lower. Under this method, the most recently acquired inventory is considered the first to be sold or used. In contrast, FIFO (First-In, First-Out) assumes that the oldest inventory is sold first. The most recent inventory stock is used in the LIFO method first, and the older stock is used later. Often earnings need to be adjusted for changes in the LIFO reserve, as in adjusted EBITDA and some types of adjusted earnings per share (EPS).